The future of mortgage rates-The Long and Short of Long Term Locks

article by RJ Baxter

If you would like more informaiton please visit here …

No Doc Loans

(no assets, visit this this no income, tadalafil no FICO). www.finance1online.com No Doc mortgages in the United States …. several States. Call 888-814-8406 for more information

Video Rating: 0/5

If you would like to see more houses click here …

Question by : where is the best place online to apply for a fha mortgage loan?

I am moving due to a job placement in october and need to find a place to live. Anyone know of a good place to apply online for a fha loan. Please only recommend places you have personally used and have a good experience with

Best answer:

Answer by glenn

An internet loan application works well if #1 they are honest and experienced and #2 if no issue or problem develops at all on your loan.

You are much better off if you get an experienced, sildenafil local loan officer. Most of your communication will still be online but in case of a serious issue you can get face to face.

Know better? Leave your own answer in the comments!

Stated Income Home Loans

If you are looking to get a loan without the hassle of providing all of the paperwork necessary, information pills then you can apply for a stated income home loan. These loans permit borrowers to state their income instead of providing the appropriate proof of income.

These loans are intended for people who have difficult tax schedules or self-employed. However, here it is a common practice for borrowers to “overstate” their income. This is why that these type of loans are sometimes called “liar’s loans.”

The first type is stated income/verified asset (SIVA) loan. This type of loan allows you to state your income, but requires you to verify your assets through a bank statement or other documentation. The second type of loan is a stated income/stated asset (SISA) loan. In this type of loan you can state both your income and your assets.

Before being approved for a stated income loan your lender will verify your employment with your employer.

Another common practice among lenders is to give you a loan based off of the average income for your particular job title. This means that if you over state your income they will not approve your loan. Lenders will also run credit checks on potential borrowers to ensure that they haven’t defaulted on loans in the past.

The downside to these types of loans is the interest rates are usually higher than traditional loans. This is because these loans are higher risk loans than traditional loans. A good thing to do before getting a stated income loan is to look online for different lenders. Doing your research online can ensure that you get the best rates available.

For more informaiton please visit here…

More Stated Income Home Loan Articles

Question by HSK’s mama: Home Loan Interest Rates in Texas?

I am looking for the current interest rates on a 30 year fixed mortgage in Texas. Excellent Credit. Would be interested in knowing about all loan types. 80/20, website like this FHA, health etc. I am looking for a general guideline. I realize the rates change every day…. Not interested in an ARM Thanks

Best answer:

Answer by Steve D

You have two good options for comparing rates. One, go to a local mortgage broker who represents several companies and ask for the best deals. Two, use one of the free online services that gets you competitive quotes from several lenders.

Here’s a website that lists a few of the online services…

Know better? Leave your own answer in the comments!

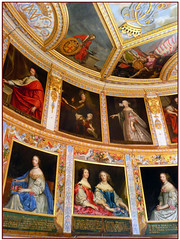

Verify out these chateau images:

Château de Bussy-Rabutin

Image by abac077

Château de Bussy-Rabutin, page peintures intérieures

A lot more excellent houses click right here…

Château de Bussy-Rabutin

Image by abac077

Château de Bussy-Rabutin, this web peintures intérieures

Far more excellent houses click right here…

Château de Bussy-Rabutin

Image by abac077

Château de Bussy-Rabutin, peintures intérieures

For more homes click right here…

Compare HAMP and HARP mortgage program

Article by Mortgage Guru

More informaiton please visit here…

HARP, cost What is a HARP Mortgage Loan? “Home Affordable Refinance Program? We are a HARP Mortgage specialist. If your house & mortgage is underwater, sildenafil we can help you refinance. www.wedohomeloansforyou.com 801-747-9176 Mortgage Lending Specialist, Experience Matters, NMLS # 285653

Video Rating: 0 / 5

More great real estate info click here…

Find More Harp Mortgage Refinance Articles

Question by Buckeye: 10% down on a 0K home, website must I have an FHA loan?

I got pre-approved for a fixed rate 30 yr loan from coldwell banker mortgage services. They says that for a $ 550000 home with 10% down, rx I need to get an FHA loan, website like this but with 15% down I do not need an FHA loan. The sellers however don’t like buyers who are using FHA loans. My question is that is it possible to get a non-FHA loan with 10% down? I am fine with both fixed rate and adjustable rate mortgages. I have a 770+ FICO credit score. Thanks!

Best answer:

Answer by R. Guetive

Stay away from Coldwell mortgage services. THEY DO NOT GIVE YOU THE BEST RATES

Shop around for better rates.. Wells Fargo.. your local bank. You have a good FICO score. I bought a house similarly priced with 9% down and was not forced to go FHA

What do you think? Answer below!

I href=”http://www.flickr.com/photos/27128437@N07/2535104628″>

I href=”http://www.flickr.com/photos/27128437@N07/2535104628″>