Common & Poor’s plans to update its credit ratings for the world’s 30 greatest banks inside 3 weeks and may possibly nicely mete out a few downgrades in the process, ed possibly surprising battered global bond markets.

Mortgage News

For more informaiton please check out here…

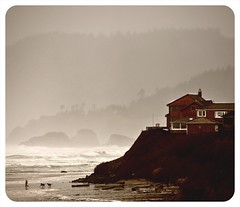

Some cool big home pictures:

Large House Construction Season in Ann Arbor, dosage Michigan

Image by cseeman

Walking about Ann Arbor these days…oh the cranes and work!

For far more houses click here…

Big House Construction Season in Ann Arbor, price Michigan

Image by cseeman

Walking about Ann Arbor right now…oh the cranes and function!

If you would like to see more properties click here…

Big Property Construction Season in Ann Arbor, abortion Michigan

Image by cseeman

Walking around Ann Arbor these days…oh the cranes and function!

Far more great houses click here…

To boost revenues, approved Bay Region governments have been expanding how they collect transfer taxes.

National Actual Estate Investor

If you would like more informaiton please go to here…

Hard Income Lenders to the Rescue

Article by Carrie Dawson

If there is a property to flip, buy but do not have the funds, cheapest who you gonna call? Challenging money lenders! Yes, information pills you can sing that to the tune of the “Ghostbusters” song, but that is true.

Also recognized as private lenders, these people are deemed rescuers of investors who have the nose for discovering the finest offers but simply do not have sufficient funds to proceed. They are a crucial component of the actual estate investing cycle.

For those who do not know considerably about this type of financing, it is normal to be discouraged, specially if you heard that tough money lenders impose a high interest rate. Compared to classic lenders, private lenders offer loans with about an 18% interest. Other people take a certain quantity of “point,” which is equivalent to one percentage point of the loaned quantity. The interest they use is generally double that of classic lenders like banks. But they have a very good cause for that: It is just a little value you pay for acquiring the funds you need, fast and simple.

In contrast to standard financing, hard money funding is significantly easier to secure. A lot of this convenient process has to do with the way hard income lenders assess borrowers. Unlike banks, they do not scrutinize the creditworthiness of a individual. They do not base their selection on your credit score or your present income but on the deal you are presenting.

For example, if you strategy to flip a property utilizing tough money funding, they will examine regardless of whether the property you want to rehab indeed is lucrative. If they see that it will yield positive returns, and that you will be in a position to repay the loan with it, then you will probably get the financing.

Difficult funds funding, unlike traditional loans, may possibly be released in just days. Negotiation for the loan is also simpler considering that you are not dealing with a processing team or panel widespread to classic lenders. If the lender says “yes,” that is it, you get the loan. It is a great choice for investors simply because it is rapid and straightforward access to funds.

Difficult income lenders make real estate investing in today’s economic condition considerably less complicated. To find out much more about tough income funding and something about actual estate investing, check out REIwired.com. The website has a database of videos, articles, and sound files that talk about various topics on genuine estate. You can also enroll in the site’s online plan about investing in actual estate.

About the Author

For a lot more Suggestions on Real Estate Investing go to: REIWired.com/about

Much more informaiton please pay a visit to here…