Learn How To Get Approved For A FHA Loan Modification Today

… criteria which applicants could be needed to fulfill apart from the fact that borrowers will be required to prepare and furnish correct as well as accurate paperwork if they intend to enhance their chances of obtaining an approval from their FHA …

More informaiton please visit here…

Wells Fargo Sued Over Claims It Falsely Certified FHA Loans

An audit released in 2011 found that half of loans originated by 15 lenders didn't meet FHA standards for verifying borrowers' income and other underwriting standards. The agency has paid more than $ 37 billion in claims related to defaulted mortgages …

If you would like more informaiton please visit here…

CAP Credits FHA for Its Useful Ignorance, buy more about no rx Allowing Mortgage Fraud to Continue

First, a word on what the FHA does. They're basically a government-run mortgage insurer, backstopping loan losses for private lenders for a nominal fee that borrowers eventually pay. FHA loans typically allow first-time homebuyers and families of more …

More informaiton please visit here…

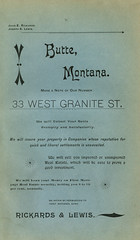

Rickards & Lewis

Image by Butte-Silver Bow Public Library

Rickards & Lewis

We will collect your rents promptly and satisfactorily.

Image from page 92b of Anaconda Standard Almanac 1893.

Unique ID: mze-anac1892

Type: Serial

Contributors:The Anaconda Standard Print, viagra 60mg Book and Job Department

Date Digital: March 2010

Date Original: 1892

Source: Butte Digital Image Project at Montana Memory Project (read the book)

Library: Butte-Silver Bow Public Library in Butte, Montana, USA.

Rights Info: Public Domain. Not in Copyright. Please see Montana Memory project Copyright statement and Conditions of Use (for more information, click here). Some rights reserved. Attribution-Noncommercial-No Derivative Works.

More information about the Montana Memory Project: Montana’s Digital Library and Archives.

More information about the Butte-Silver Bow Public Library.

Search the Butte-Silver Bow Public Library Catalog.

If you would like to see more homes click here…

Useful Information On Obama Housing Plan 2012

“Obama housing plan is designed to help struggling homeowners manage their mortgage payments properly. Few changes were also made in the Obama housing plan qualifications to enable more number of homeowners get benefited with the foreclosure …

More informaiton please visit here…

Keyes failed to report home buy, mortgage

… officials are required to annually disclose their assets with the State Ethics Commission, including property owned in Massachusetts, the purchase or sale of property over the past calendar year and any loan or mortgage information in excess of $ 1,000.

For more informaiton please visit here…

Question by Nicholas: Is there any way to reduce/remove mortgage insurance on 30-year fixed FHA loan inside of 5 years?

I bought a house in Miami in December, and 2011 using a 30-year fixed FHA mortgage. I have more than 50% equity in the home. At the time I hadn’t lived in the USA for over two years so I didn’t have enough credit to qualify for a conventional loan. Would I be responsible for FHA mortgage insurance even if I refinance to a conventional loan?

Thanks to the first responder, approved to the second: We are more concerned with getting out of paying five years of useless mortgage insurance to the FHA when our Loan-to-Equity ratio is less than 50%. It’s difficult to see how a hardship letter would help, but thank you anyways.

Best answer:

Answer by chatsplas

NOPE

FHA insurance is only for FHA loans

And with more than 20% equity in property, when you refi, you won’t have to pay PMI, which is a substantial extra monthly cost in addition to the initial premium

Add your own answer in the comments!