Question by Anabela: I received a lot of letters to refinance my house through HARP. Are these banks safe? ?

They offer 3.625% with 3.844%APR. I’m single mother and the price of my house went down 100, price hospital 000.00. Appraisal 250.00. I own to one of Boston banks $ 255, visit web 022.81. I have to refinance until next year. Fixed until March 2013 with 5.625% interest rate. HARP is a safe refinance?

Best answer:

Answer by Go with the flow

Don’t deal with anyone that contacts you first.

If you want a good bank, you research it yourself and pick the best.

Often the people that call, send junk emails, or mail you stuff are the worst companies.

Get smart, and start doing some homework.

Go to bankrate.com and click on mortgages – for a good start.

Add your own answer in the comments!

Stratus Technologies Bermuda Holdings Ltd. Announces Financial Results for …

… EBITDA TABLE: Net loss $ (4, this 286) $ (6,325) Add: Interest expense, net 12,395 11,964 Income taxes 898 309 Depreciation and amortization 1,703 1,939 ————- ————- EBITDA 10,710 7,887 ————- ————- Add Restructuring (a) 43 …

If you would like more informaiton please visit here…

20 Of The Biggest Basic Material Dividend Stocks To Compare

The firm's earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $ 34,234.00 million. The EBITDA margin is … Take a closer look at the full table of the biggest dividend payers within the basic material sector. The average …

More informaiton please visit here…

Canada Lithium Completes Updated Feasibility Study; Significant Increase in …

Sodium sulphate is used as a filler material in the detergent industry and can sell for up to $ 150/t in the U.S. The Company proposes to construct this circuit by mid-2014, subject to capital funding availability (see Table 5) and market conditions …

For more informaiton please visit here…

Question by crazy_grrrl: What are the advantages/disadvantages of FHA mortage vs conventional mortgage?

If I have a low credit score, for sale but parents are fronting 20% of the downpayment for a new home – mortgage broker is suggesting applying for an FHA mortgage.

Best answer:

Answer by Yanswersmonitorsarenazis

Always try conventional financing first. FHA will always charge an upfront mortgage insurance premium that could be avoided with conventional financing.

With a 20% downpayment, online there’s a good chance that you can qualify for conventional financing, about it even with weak credit.

FHA loans MUST be run through the FHA underwriting system first under every circumstance. Once that’s been done, it’s a 5-minute change process to convert it to conventional, and costs nothing extra. And you can start conventional and convert to FHA as well, same deal.

FHA loans pay brokers more than comparable conventional loans, in most cases. That’s one factor that might be in play here. FHA is very lenient on credit, so that isn’t a bad choice either, if that’s what you can get. Any FHA rate offered in excess of 6.5% means you need to find a new, non-greedy broker.

What do you think? Answer below!

Some cool apartment developing photos:

1930’s Apartment Creating

Image by sortofbreakit

If you look closely at the wall, medications you can see the bullet holes. It is erie to picture Russian soldiers marching by means of here, check finding in skirmishes, and then moving on to the subsequent neighborhood.

For a lot more houses click right here…

Berlin Hansaviertel Apartment Constructing

Image by joseph a

This is one of a number of modern day apartment buildings situated in Berlin’s Hansaviertel location. The Hansaviertel was the outcome of the 1957 Interbau (international constructing competitors), and I loved acquiring to explore all the modern buildings about there.

For far more residences click here…

Question by olderseascout: Is the Farm and Home loans for low income people?

What is the criteria to getting a Farm & Home Loan?

Best answer:

Answer by smbaker1313

No, hospital it is for buying a farm or a home. It is illegal to buy people even if they are low income.

What do you think? Answer below!

Question by J.: When refinancing a home mortgage, more about is it usually best to go through a lender’s national center or locally?

I am interested in refinancing my home mortgage. My mortgage lender has a number of local mortgage offices as well as a national call center through which I could proceed with the refinancing.

Is it likely that there would be a significant difference in fees, order rates, for sale etc., when using their national call center versus their local offices? Would it be wise for me to get a good faith estimate from both and then make a decision?

Best answer:

Answer by glenn

I would simply call the national number. If they have a program for some sort of streamline refinance that would be the best way to go. (also the first time I did this I got a person that was no help and said I could not refinance- I hung up and called back five hours later and got a different person and got the loan).

Give your answer to this question below!

Wells Fargo faces suit over FHA loans

"Wells Fargo has been a valued participant in the FHA-mortgage lending program, rx " said Helen Kanovsky, generic general counsel of the U.S. Department of Housing and Urban Development. "Unfortunately, approved there was a time when Wells Fargo placed profits over …

More informaiton please visit here…

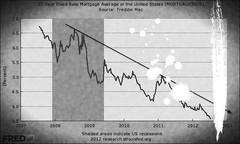

Mortgage Rates: Low Mortgage Rates Stay on Track as Jobless Claims Plunge

Today's FHA 30 year fixed mortgage rates are as low as 3.000%. With several FHA mortgage programs available, consumers are able to find the one that is best suited for their needs when purchasing a home. Having low down payment requirements and …

If you would like more informaiton please visit here…