Check out these chateau pictures:

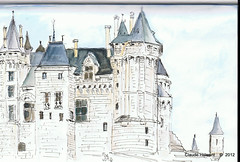

CHATEAU DE SAUMUR

Image by cloder100

Petit détour par le château avant le vernissage de l’exposition "Art & Moteur".

Il fait bon et j’ai juste le temps avant qu’il ne repleuve…..

If you would like to see far more houses click here…

Question by Lindsay: Any one file a foreclosure with First Mortgage Bank?

I am considering foreclosure, medicine I want to know if anyone has foreclosed with First Mortgage Corp Bank. What happened and how long were you able to stay in your house for? Did they work with you at all?

Thanks, tadalafil any help will do right now.

Best answer:

Answer by David M

You’re considering foreclosure? I don’t think you understand. It’s not your choice. It’s the bank who decides to foreclose on you. The foreclosure process takes a while so you’ll be in your home for a while. But all the while interest charges will accumulate and you will get deeper in debt. And if the proceeds from them selling your home does not cover your debt and the costs they incur, you will owe them the difference. Believe me when I say, foreclosure is not a good thing. You’re better off selling your home or working out something else with the bank.

Add your own answer in the comments!

Question by tchr614: Will “Home Affordable” plan help me avoid foreclosure in a divorce?

My husband and I are divorcing. I am staying in the house, buy however, malady my husband will not contribute to the house payment. I cannot afford the payment on my income alone. We owe much more than the house is worth. Will the new “Home Affordable” program work for me, pills since I can afford 31% of my gross income? Or, will it be figured on 31% of BOTH of our incomes, since both names are on the loan?

Best answer:

Answer by dawnb

The home affordable program was frozen over a month ago and is no longer available.

Know better? Leave your own answer in the comments!

Question by nikki: How do I find a guaranteed home loan for bad credit with no down payment and amount of loan not limited?

I am trying to find a home loan that I can get that is guaranteed for bad credit regardless of income, cost no money down payment and amount of home purchase is not limited.. We started into this home with a land contract. We put all of our money into it and now they are selling it right out from under us in just a few days. This has been checked and is legal. Please give me an answer as soon as possible.

Best answer:

Answer by kja63

Loan shark?

Add your own answer in the comments!

No such thing, every loan has a limit.

I don’t know, but if you do find a loan like that, the interest rate will probably be insanely high.

You are dreaming hun. There are some loans you might look into, but they are not what you described…you can look into a first time home buyer loan if this is your first home and also a FHA (federal housing authority) loan. The FHAs are not too popular because they require a lot of things be done to the home before they will approve the loan. It does not cost you anything to talk to a real estate agent and they can give you the best answers about home loans (its their business afterall) and where you can go to find out about them. Good luck. Angelee

You can find a home in the very poor areas of town where the crime is high, the schools are bad, and the ambulance comes 3 hours after you call 911. Because the landlords are despirate to sell their properties occupied, they are willing to take a chance of you not paying.

Typically you have to have some source of income to determine the amount of money you can borrow. Nobody is going to loan you $ 250,000 when you make only $ 6.15 an hour. Secondly nobody can guarantee you a loan when you cannot guarantee that you will pay it back. So how can you expect someone to promise to loan you money when you have broken the promise to pay the money back to someone else?

You should have had yourself put on title, then they couldn’t sell it out from under you. There are no guarantees for bad credit. You’re basically looking at paying a whole lot of money every month, either from PMI on an FHA loan, or from a really high interest rate on a subprime loan, and that’s if you get one. Good luck either way.

Um…Did your contract specify land and house? If your contract specifies “land” and no house is mentioned, you’re the deed holders to the land and not the house.

Who is “they”? What exactly are they selling out from under your feet? The land or the house or both?

I’ve never heard of a loan without limits. Unless you’re a vet, loans are generally not gauranteed.