A few good condominium photos I identified:

Fotoloco The Alexandra Condominium Halloween Party by Ortigas and Company 070

Image by FOTOLOCO!

Fotoloco photo booth images @ The Alexandra Condominium Halloween Celebration | Ortigas & Business | Viridian in Greenhills | All-you-want photo prints from Fotoloco photo booth

For much more houses click right here…

Fotoloco The Alexandra Condominium Halloween Party by Ortigas and Firm 089

Image by FOTOLOCO!

Fotoloco photo booth pictures @ The Alexandra Condominium Halloween Party | Ortigas & Firm | Viridian in Greenhills | All-you-want photo prints from Fotoloco photo booth

For more homes click here…

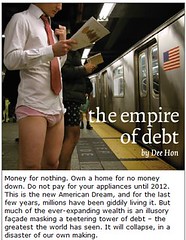

The Empire of Debt by Dee Hon

Image by Renegade98

From Adbusters #74, generic Nov-Dec 2007

The Empire of Debt

Money for nothing. Own a home for no money down. Do not pay for your appliances until 2012. This is the new American Dream, and for the last few years, millions have been giddily living it. Dead is the old version, the one historian James Truslow Adams introduced to the world as “that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement.”

Such Puritan ideals – to work hard, to save for a better life – didn’t die from the natural causes of age and obsolescence. We killed them, willfully and purposefully, to create a new gilded age. As a society, we told ourselves we could all get rich, put our feet up on the decks of our new vacation homes, and let our money work for us. Earning is for the unenlightened. Equity is the new golden calf. Sadly, this is a hollow dream. Yes, luxury homes have been hitting new gargantuan heights. Ferrari sales have never been better. But much of the ever-expanding wealth is an illusory façade masking a teetering tower of debt – the greatest the world has seen. It will collapse, in a disaster of our own making.

Distress is already rumbling through Wall Street. Subprime mortgages leapt into the public consciousness this summer, becoming the catchphrase for the season. Hedge fund masterminds who command salaries in the tens of millions for their supposed financial prescience, but have little oversight or governance, bet their investors’ multi-multi-billions on the ability that subprime borrowers – who by very definition have lower incomes and/or rotten credit histories – would miraculously find means to pay back loans far exceeding what they earn. They didn’t, and surging loan defaults are sending shockwaves through the markets. Yet despite the turmoil this collapse is wreaking, it’s just the first ripple to hit the shore. America’s debt crisis runs deep.

How did it come to this? How did America, collectively and as individuals, become a nation addicted to debt, pushed to and over the edge of bankruptcy? The savings rate hangs below zero. Personal bankruptcies are reaching record heights. America’s total debt averages more than 0,000 for every man, woman, and child. On a broader scale, China holds nearly trillion in US debt. Japan and other countries are also owed big.

The story begins with labor. The decades following World War II were boom years. Economic growth was strong and powerful industrial unions made the middle-class dream attainable for working-class citizens. Workers bought homes and cars in such volume they gave rise to the modern suburb. But prosperity for wage earners reached its zenith in the early 1970s. By then, corporate America had begun shredding the implicit social contract it had with its workers for fear of increased foreign competition. Companies cut costs by finding cheap labor overseas, creating a drag on wages.

In 1972, wages reached their peak. According to the US department of Labor Statistics, workers earned 1 a week, in inflation-adjusted 1982 dollars. Since then, it’s been a downward slide. Today, real wages are nearly one-fifth lower – this, despite real GDP per capita doubling over the same period.

Even as wages fell, consumerism was encouraged to continue soaring to unprecedented heights. Buying stuff became a patriotic duty that distinguished citizens from their communist Cold War enemies. In the eighties, consumers’ growing fearlessness towards debt and their hunger for goods were met with Ronald Reagan’s deregulation the lending industry. Credit not only became more easily attainable, it became heavily marketed. Credit card debt, at 0 billion, is now triple what it was in 1988, after adjusting for inflation. Barbecues and TV screens are now the size of small cars. So much the better to fill the average new home, which in 2005 was more than 50 percent larger than the average home in 1973.

This is all great news for the corporate sector, which both earns money from loans to consumers, and profits from their spending. Better still, lower wages means lower costs and higher profits. These factors helped the stock market begin a record boom in the early ‘80s that has continued almost unabated until today.

These conditions created vast riches for one class of individuals in particular: those who control what is known as economic rent, which can be the income “earned” from the ownership of an asset. Some forms of economic rent include dividends from stocks, or capital gains from the sale of stocks or property. The alchemy of this rent is that it requires no effort to produce money.

Governments, for their part, encourage the investors, or rentier class. Economic rent, in the form of capital gains, is taxed at a lower rate than earned income in almost every industrialized country. In the US in particular, capital gains are being taxed at ever-decreasing rates. A person whose job pays 0,000 can owe 35 percent of that in taxes compared to the 15 percent tax rate for someone whose stock portfolio brings home the same amount.

Given a choice between working for diminishing returns and joining the leisurely riches of the rentier, people pursue the latter. If the rentier class is fabulously rich, why can’t everyone become a member? People of all professions sought to have their money work for them, pouring money into investments. This spurred the explosion of the finance industry, people who manage money for others. The now- trillion mutual fund industry is 700 times the size it was in the 1970s. Hedge funds, the money managers for the super-rich, numbered 500 companies in 1990, managing billion in assets. Now there are more than 6,000 hedge firms handling more than trillion dollars in assets.

In recent years, the further enticement of low interest rates has spawned a boom for two kinds of rentiers at the crux of the current debt crisis: home buyers and private equity firms. But it should also be noted that low interest rates are themselves the product of outsourced labor.

America gets goods from China. China gets dollars from the US. In order to keep the value of their currency low so that exports stay cheap, China doesn’t spend those dollars in China, but buys us assets like bonds. China now holds some 0 billion in such US IOUs. This massive borrowing of money from China (and to a lesser extent, from Japan) sent us interest rates to record lows.

Now the hamster wheel really gets spinning. Cheap borrowing costs encouraged millions of Americans to borrow more, buying homes and sending housing prices to record highs. Soaring house prices encouraged banks to loan freely, which sent even more buyers into the market – many who believed the hype that the real estate investment offered a never-ending escalator to riches and borrowed heavily to finance their dreams of getting ahead. People began borrowing against the skyrocketing value of their homes, to buy furniture, appliances, and TVs. These home equity loans added 0 billion to the US economy in 2004 alone.

It was all so utopian. The boom would feed on itself. Nobody would ever have to work again or produce anything of value. All that needed to be done was to keep buying and selling each other’s houses with money borrowed from the Chinese.

On Wall Street, private equity firms played a similar game: buying companies with borrowed billions, sacking employees to cut costs, and then selling the companies to someone else who did the same. These leveraged buyouts inflated share values, minting billionaires all around. The virtues that produce profit – innovation, entrepreneurialism and good management – stopped mattering so long as there were bountiful capital gains.

But the party is coming to a halt. An endless housing boom requires an endless supply of ever-greater suckers to pay more for the same homes. The rich, as Voltaire said, require an abundant supply of poor. Mortgage lenders have mined even deeper into the ranks of the poor to find takers for their loans. Among the practices included teaser loans that promised low interest rates that jumped up after the first few years. Sub-prime borrowers were told the future pain would never come, as they could keep re-financing against the ever-growing value of their homes. Lenders repackaged the shaky loans as bonds to sell to cash-hungry investors like hedge funds.

Of course, the supply of suckers inevitably ran out. Housing prices leveled off, beginning what promises to be a long, downward slide. Just as the housing boom fed upon itself, so too, will its collapse. The first wave of sub-prime borrowers have defaulted. A flood of foreclosures sent housing prices falling further. Lenders somehow got blindsided by news that poor people with bad credit couldn’t pay them back. Frightened, they staunched the flow of easy credit, further depleting the supply of homebuyers and squeezing debt-fueled private equity. Hedge funds that merrily bought sub-prime loans collapsed.

More borrowers will soon be unable to make payments on their homes and credit cards as the supply of rent dries up. Consumer spending, and thus corporate profits, will fall. The shrinking economy will further depress workers’ wages. For most people, the dream of easy money will never come true, because only the truly rich can live it. Everyone else will have to keep working for less, shackled to a mountain of debt.

_Dee Hon is a Vancouver-based writer has contributed to The Tyee and Vancouver magazine.

Adbusters Magazine

adbusters.org/the_magazine/74/The_Empire_of_Debt.html

If you would like to see more homes click here…

Federal Home Loan Bank of New York Announces Third Quarter 2012 Operating …

NEW YORK, Oct. 26, 2012 — /PRNewswire/ — The Federal Home Loan Bank of New York ("Bank" or "FHLBNY") today released its unaudited financial highlights for the quarter ended September 30, 2012. "Throughout the first nine months of … Return on …

If you would like more informaiton please visit here…

Legal forum looks at pros, cons of reverse mortgages

Homeowners may be placed in default if they transfer a deed to a home with a mortgage without telling the mortgage company. — If parents are still living in the home they have … “A reverse mortgage is a mortgage against a [portion] of equity in your …

For more informaiton please visit here…

Why This is No Time to Borrow “On Margin”

“Margin loans” allow you to borrow against the value of your brokerage account at rates often below those you could get on other debt secured by your own assets, like a home-equity loan. Current rates range from approximately 6% to less than 1%. And …

More informaiton please visit here…

Question by john: I have a question about loan Modifcation and your credit?

March of last year I lost my job through no fault of my own company went out of biz. I have a mortgage where my APR is 9%. In July I called Bank of America where I bank and ask about a refinance she said they cannot do one because one we owe 155k home is worth 120k and I am on unemployment. She did offer the making homes affordable program and switched me over to the loan modification dept. I talked to them and they took all of my income and expenses over the phone then they asked me to fax pay stubs, purchase hardship letter, viagra unemployment proff. they told me it will take 30-45 days to review the info. Did not hear anything from them and then I called on day 45 they said they are still reviewing it. I thought this was a wash, ask we have also made our payment on time every month. Then this last week Fed-ex showed up with an envelope with a one page letter from BoA letting us know what a trial payment will be our Original payment was 1600 trial payment is 1090 it also said in a few days you will get more details. Yesterday Nov 2 another package showed up from Fed ex this time a thicker package with a check list of more pay stubs, tax documents ect. This also had three cupons with a trial payment of 1077 one due Dec 1, Jan 1, Feb 1. I still have not paid anything for Nov yet. So i went online to make a Nov payment and it was blocked and said call #1866 as this account has a special curmenstance. I called them up talked to a rep they said you are now in a trial payment asked it they can set up an automatic payment for that I said sure they set it up to be drafted Dec 1st. I asked him about the Nov payment I have not made one yet he told me dont worry about it. I also asked about if this was going to hurt my credit score he told me there is no way shape or form it will hurt me credit score. Only way it will hurt your score if you dont pay your trial payment. I have been reading some people have been taking a hit on there credit even as they where told by there lender it will not. I recently got an offer from a credit card that gave me a 4.99% until balance is paid in full, they gave me a check to write out on my line of credit to my checking account this was 7k. I would hate for my loan company to put a late then my credit card would come back with the universal defuate clase and jack my APR up. Do you think they can disclose this in writting or record a conversation with them.

Any thoughts would be great.

Thanks

Best answer:

Add your own answer in the comments!

Question by Amanda C: Question about PMI for FHA mortgage loan?

I was looking over our commitment letter for our mortgage from Wells Fargo and it states…

“For an FHA loan, viagra 100mg Buyer must either pay or finance the up-front mortgage insurance premium of $ 1,832.50 and must pay a monthly MIP charge to start at $ 136.47 per month.”

I was confused about this as I didnt realize that there are two separate payments here….

This basically means that I have to pay $ 1,832.50 up front (or finance) AND pay another $ 136.47 per month. If I choose to finance the first part, it would be $ 152.71 plus $ 136.47 per month that I’d be paying for the PMI.

Does this sound right? Everyone I’m speaking to says that it sounds a little high…. I called the mortgage banker and he confirmed that this is 2 separate payments per month, BUT I have called and asked him questions in the past and he has given me incorrect info…. So I was hoping he’s wrong about this too!! I can definitely afford it, but it’s expensive!!

Any thoughts??

It doesnt say….. I’m wondering if that $ 1,832.50 is an upfront fee meaning that it’s a one time fee (unless you finance) and that after we pay that off, we continue with just the $ 136.47 per month…..

Best answer:

Answer by pickmefirstplz

how many months would you have to pay the $ 152.71?

What do you think? Answer below!

You pay PMI until you have 20% equity

You don’t have to pay upfront of $ 1,832.50 if you can’t pay in full. They will charge you $ 152.71 per month from your escrow balance (short). Also you will be charged $ 136.47 per month for PMI. It is likely your mortgage payment will increase if you decided to pay $ 152.71 per month. If you pay upfront and your mortgage payment will be the same per month. I am with Wells Fargo Mortgage for almost 7 years. Hope it helps.